Immigration Insights

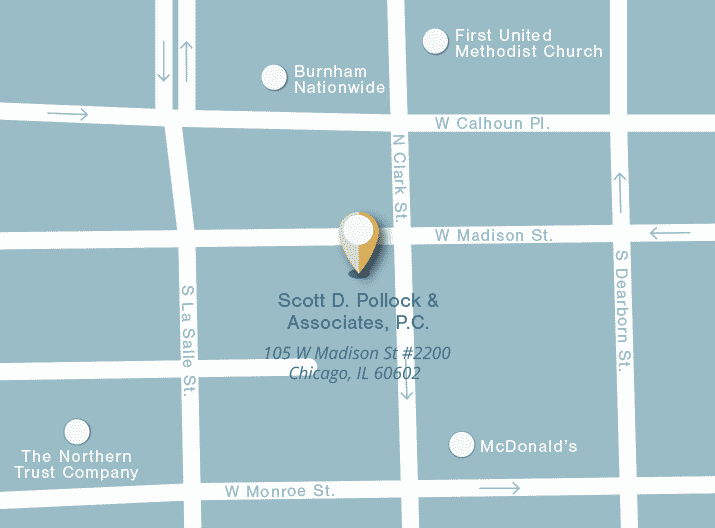

A joint sponsor, or financial co-sponsor, is a U.S. citizen or lawful permanent resident who can help an applicant for a family-based green card meet the income requirements by committing to assuming the legal and financial obligation of supporting them. To learn more about being a joint sponsor for a green card, contact Scott D. Pollock & Associates at (312) 444-1940.

Having a joint sponsor can be beneficial when the primary sponsor’s household income and assets are insufficient to satisfy the minimum monetary requirement for obtaining a green card.

Joint sponsors are typically close relatives who agree to provide additional financial resources and the necessary documentation to demonstrate their ability to support the applicant, such as bank statements, tax returns, and proof of employment.

Joint sponsorship for immigration is a legal commitment made by an individual, typically a U.S. citizen or permanent resident, to provide financial support to a foreign national looking to obtain a green card. This commitment is intended as an insurance policy for the U.S. government if the primary sponsor falls short of fulfilling their financial obligation.

The joint sponsor will be asked to provide evidence of their financial capacity and enter into an agreement with the Department of Homeland Security that outlines their responsibilities and the duration of their commitment.

Do I Need A Joint Sponsor? When Is It Needed?

You may need to have a joint sponsor if your primary sponsor does not meet financial eligibility for sponsorship. The same applies if you apply for your green card based on marriage, where your primary sponsor is your spouse.

This means that the primary sponsor must have enough assets and/or household income to satisfy the minimum threshold set by the U.S. Citizenship and Immigration Services (USCIS). If this isn’t possible, then you may need to enlist a joint sponsor who can make up for any deficiencies, either in terms of assets or household income.

The primary sponsor must make at least 125% of the federal poverty guidelines based on household size and location. Specifically, if you are a couple living in the mainland United States with no children, then your annual income should be around $22,887. This figure changes from year to year based on inflation and the cost of living.

If the primary sponsor’s income for their most recent tax filing meets the requirement but their income for the previous year did not, this could necessitate a joint sponsor. Additionally, if your primary sponsor uses non-U.S. income as qualification criteria, but that income is reflected as a loss on their federal income tax return (IRS Form 1040), you will also require a joint sponsor to provide sufficient resources and evidence of financial stability.

It’s important to note that the income must be positive on the tax return for the primary sponsor to qualify as a sole sponsor.

If the primary sponsor’s income is insufficient to meet the minimum income requirement, then their assets must be equal to at least five times the difference between their income and the minimum amount specified by the U.S. Citizenship and Immigration Services (USCIS).

Who Can Be A Joint Sponsor?

To be a joint sponsor for a green card, you must meet several eligibility criteria. You must be a United States Citizen or hold a green card and be at least 18 years old. Additionally, you must reside in the United States or one of its territories and have an annual income that is equal to or more than 125% of the federal poverty level for your household size and location, both in the most recent tax filing year and the current year.

Additionally, as a joint sponsor, you are required to accept financial responsibility for providing support for the applicant seeking a green card.

A joint sponsor for a green card application does not have to be related to the sponsoring spouse or the applicant; anyone who meets the requirements can fulfill this role. It could be a friend or family member. If the joint sponsor is living with your spouse, Form I-864A, known as “Contract Between Sponsor and Household Member,” must be completed by the potential joint sponsor.

What Are A Joint Sponsor’s Responsibilities?

Financial Support

The joint sponsor is responsible for providing financial support to the intending immigrant so they do not become a public charge. This means that the primary sponsor and joint sponsor must maintain a minimum combined household income of at least 125% of the Federal Poverty Guidelines.

They are obligated to provide financial assistance for basic living expenses such as food, rent, and bills but are not required to pay taxes or any private debt such as credit card debt or other loan payments. The joint sponsor is not responsible for any situations between the intending immigrant and law enforcement.

Use Of Public Benefits

A joint sponsor for a green card must pay for any use of public benefits to the immigrant. This support may include reimbursement of government agencies for any public benefits the applicant uses. These could include Medicaid, Supplemental Security Income (SSI), Food Stamps, Temporary Assistance for Needy Families (TANF), and other public assistance programs provided by federal, state, or local agencies.

The joint sponsor and primary sponsor for a green card holder are obligated to reimburse any applicable federal, state, or local government agencies for any benefits used by the sponsored individual before their financial obligation is completed.

It is important to note that not all benefits received by the sponsored individual may require repayment. Still, it is always good practice to check with government officials before using publicly-funded services. The available benefits can be found on the USCIS rules website.

When applying for benefits, it is essential to note that some government agencies may consider the income of your financial sponsor when determining your eligibility. This means that if you have a joint sponsor, their income may be added to your own when calculating how many benefits you are eligible for.

Unfortunately, this could result in fewer benefits or even denial of services altogether. So, it’s worthwhile to investigate the specifics regarding joint sponsorship when considering green card benefits to ensure that you receive the most accurate and favorable assessment of your situation.

Keeping Your Address Up To Date

Provide timely notification to the USCIS whenever you change your address. To do this, joint sponsors must fill out Form I-865, also known as the “Sponsor’s Notice of Change of Address” within 30 days of moving.

What Happens If My Joint Sponsor Doesn’t Uphold Their Obligations?

If a joint sponsor for immigration fails to fulfill their obligations, they may be subject to consequences. These could include not proceeding with the application process or paying back the benefits they have already provided.

If the joint sponsor cannot provide adequate financial support, you as the applicant may be forced to take legal action against them to obtain the necessary funds. In such cases, it becomes possible for you to file a lawsuit and seek damages from them for not fulfilling their obligation of sponsoring you as a part of the immigration process. If your sponsor fails to update your address with the USCIS, this could lead to them being fined $250 to $5,000 based on whether it was intentional.

Green card holders have rarely taken this action against sponsors. Regarding what actions can be taken against a non-compliant joint sponsor, there are a few options available depending on the specifics of each situation.

The government could press charges to demand repayment of public benefits received, as well as for collection costs and legal fees associated with bringing the case to court. In most cases, these proceedings are rare, but sponsors need to understand that the failure to meet their financial commitments creates a potential liability.

Situations Where Responsibilities For The Sponsor May End

A joint sponsor’s responsibilities in helping an immigrant obtain a green card may be terminated in some scenarios. These include the green card holder’s acquisition of U.S. citizenship, the completion of forty quarters (or ten years) of working within the United States, leaving the country after no longer being a green card holder, death, and receiving a new green card due to facing deportation proceedings.

In any of these circumstances, the duties and obligations of being a joint sponsor for a green card are no longer applicable and can be considered complete. When a joint sponsor for a green card passes away, their legal obligation to financially support the applicant ceases to exist.

However, if the deceased had already given money, made any other financial aid commitments, or owed money to the green card holder before their death, the state may require that payment be taken out of their estate and given to the applicant in accordance with applicable laws. In instances where the applicant and the joint sponsor divorce, then the joint sponsor’s obligations remain intact and they must still provide any financial support necessary.

How To Become A Joint Sponsor

To be considered a joint sponsor for an immigrant, an individual must meet certain financial requirements. Their total income must be at least 125% of the applicable federal poverty level for their household size and geographic area, according to the most recent tax filing and the present year. The income that can be considered includes wages, salaries, alimony payments, and retirement benefits.

Each household member whose income or assets are being used to meet the sponsor’s requirements must also complete Form I-864A by the Immigration and Nationality Act (INA). All individuals involved must provide documentation demonstrating that their combined contributions satisfy the financial obligations included in this form.

This document serves as proof of sufficient resources to support the sponsored individual, including any dependents. Additionally, all parties should be aware of any discrepancies in terms of income or assets that could disqualify them from fulfilling their role as joint sponsors.

Once the potential sponsor is sure they qualify, they should complete the Form I-864, Affidavit of Support. Along with this form, they will also need to attach supporting documents that prove their U.S. citizenship or lawful permanent resident status, proof of income and assets (if applicable), as well as proof of U.S. residency (such as pay stubs, mortgage statements, bank statements, registering children in U.S schools).

Additionally, if there are any dependents or household members who will be combining their income or assets with the joint sponsors’, then a Form I-864A will also have to be provided. It is important to note that all documents should be provided in their original form or certified copies from the issuing agency.

Hiring An Attorney For Joint Sponsorship

A joint sponsorship application for a green card can be a daunting and complex process, but it is possible. An immigration attorney will have the expertise and knowledge to assess your situation accurately, ensure that all documents are completed correctly, and advise you on the best route to take.

They will also be able to provide insight into any potential legal issues or obstacles that may arise during the process and how to navigate them most effectively.

An attorney can help save time by efficiently filing paperwork and keeping track of deadlines. Working with a trustworthy and experienced immigration lawyer can make the entire experience much smoother and increase the likelihood that your application is approved as quickly as possible.

Contact an Experienced Immigration Attorney at Scott D. Pollock & Associates, P.C.

If you are considering becoming a joint sponsor for an immigrant or if you need help with any other aspect of the immigration process, contact an experienced immigration attorney at Scott D. Pollock & Associates, P.C. Our team of knowledgeable attorneys can provide the legal guidance and support you need to make informed decisions about your situation and successfully apply for joint sponsorship.

With over 30 years of helping families and individuals navigate immigration law, Scott D. Pollock & Associates, P.C., can provide you with the legal guidance and help needed to make informed decisions about your situation.

Additionally, we have the expertise to handle various immigration cases, including family-based immigration, employment-based immigration, and naturalization. Our team of knowledgeable attorneys will provide you with sound advice and work diligently to make sure your application is approved as quickly as possible. Contact us at 312.444.1940 or fill out an online form for a consultation.

View Similar Articles