Immigration Insights

For those who hold a green card in the United States, there are certain tax requirements that must be met to ensure compliance with U.S. Citizenship and Immigration Services (USCIS) regulations.

This typically means that green card holders are required to file both federal and state tax returns each year. Specialized forms or tax documents from previous years may also need to be included depending on individual circumstances. It is important to work closely with a qualified tax professional to ensure that all necessary requirements are being met so that non-compliance penalties are avoided.

With careful planning and accurate reporting, however, it should be relatively straightforward for green card holders to meet USCIS tax return requirements and maintain their lawful resident status in the US.

Do Immigrants Pay Taxes?

Yes. If you reside in the United States, you are obligated to file federal, state, and local tax returns ) and to pay your taxes, whether you are a permanent resident, an immigrant living in the States on a visa, or an undocumented immigrant.

If you are an immigrant, you are required to complete a USCIS tax return annually and accurately report all of your income from earned wages and all other income sources.

In addition to reporting your income, USCIS may also require you to submit supporting documentation such as receipts, bank statements, and evidence of tax payment. Failure to comply with USCIS tax requirements can lead to penalties and potentially even affect your eligibility for future visas or citizenship status in the United States.

If you are an immigrant in the United States, it is important to take your USCIS tax obligations seriously and stay up-to-date on any changes or new requirements that may affect you.

Certain Non-immigrant Statuses Aren’t Required to Pay Taxes

Certain non-immigrant visa statuses exempt individuals from paying the U.S. income tax from earnings paid by a foreign government or international organizations:

- Category A Visa – diplomat or foreign government official

- Category E Visa – treaty trader or treaty investor

- Category G Visa – employees of international organizations and NATO

- Category D Visa – ship or aircraft crew members aboard a foreign vessel and paid by a foreign employer

However, in some circumstances, non-immigrants will file Form I-508, Request for Waiver of Certain Rights, Privileges, Exemptions, and Immunities. You might choose to do this to be eligible for an adjustment of status to become a lawful permanent resident.

Additionally, students, scholars, professors, trainees, and researchers who hold an F-1, F-1, J-1M-1, or Q-1 Visa are exempt from Social Security and Medicare Taxes as long as they are doing work approved by the USCIS.

H-2 non-immigrants who are residents of the Philippines and perform services in Guam, and H-2A non-immigrants admitted into the United States temporarily to perform agricultural labor are exempt from Social Security and Medicare Taxes.

Do Refugees Pay Taxes?

The answer to this is complex, as there is no single answer that applies to all refugees in all situations. Most refugees are required to file a tax return with the USCIS once they are earning income in the United States above a certain threshold.

For example, refugees who work legally in the U.S. may be required to make Social Security and Medicare tax contributions. In addition, filing taxes helps determine eligibility and how much aid is provided for public assistance programs such as Supplemental Nutrition Assistance Program (SNAP), formerly called food stamps, and Medicaid.

Overall, while there is no one-size-fits-all answer to this question, it is clear that refugees do engage with the tax system in some way and are often required to contribute financially to government programs. If you are a refugee and looking for clarity on this question, reach out to the Chicago immigration attorneys at Scott D. Pollock & Associates P.C.

How Do Undocumented Immigrants Pay Federal Taxes?

Despite the fact that undocumented immigrants are not able to officially work or claim any benefits, these individuals are still required to pay taxes on their income. This is typically done through third-party reporting and employer penalties.

For example, undocumented workers can report their earnings using an Individual Taxpayer Identification Number (ITIN), which allows them to submit payments directly to the IRS. The IRS does not share ITIN numbers with immigration authorities.

Additionally, employers are held responsible if they have knowingly hired an undocumented worker, so they have a strong incentive to verify workers’ citizenship status before hiring them to avoid tax penalties.

Overall, undocumented immigrants pay an estimated $9 billion in payroll taxes every year. The reason many of these undocumented immigrants pay taxes is in the hope that it’ll help them become citizens someday by documenting when they entered the country and how long they’ve been contributing to taxes.

Which Tax Forms Do Immigrants File?

The forms you will use depend on your status:

- Green card holders will file Form 1040, just like U.S. citizens.

- Individuals with a temporary visa file their tax return using Form 1040-NR

- International students and scholars on F or J visas must file Form 8843, even if they do not earn an income while studying. Form 8843 is not a tax return. It is an informational statement required by the U.S. government. If an international student or scholar earns taxable income, they’ll also file a 1040-NR. They do not need to file a 1040-NR if they have income from foreign sources, non-taxable scholarships, or any other income not taxable by the IRS.

Is Foreign Income Taxable?

Typically, yes. Immigrants who are new to the United States may be surprised to learn that they are still required to pay taxes even if they earn their income in another country. Federal law requires U.S. tax residents to report all income no matter where in the world it is earned.

However, the Foreign Earned Income Tax Credit is available to immigrants (and citizens) who can prove that they earned their income outside of the United States. There are a few conditions that must be met in order to qualify:

First, the person applying for this tax credit must have a valid Social Security number in order to file a tax return. Second, they must have earned their income from a legitimate source, such as wages, tips, or self-employment. Finally, in order for someone to qualify for the Foreign Income Tax Credit, they must spend 330 days during the year outside of the United States. It’s also important to note that for 2022 taxes, this credit is only available to those who will have earned less than $112,000.

This tax credit is also available to U.S. citizens who reside in a foreign country for an uninterrupted period of time that includes an entire tax year. This also applies to noncitizen U.S. resident aliens who hold citizenship from a country with which the United States has an income tax treaty in effect.

Do You Need Tax Returns for a Citizenship Interview?

When applying for U.S. citizenship, you may be required to provide proof of your tax returns as part of the eligibility requirements.

While the exact details of what is required will vary depending on your individual situation, typically it is expected that you submit both your federal and state tax returns for the most recent 5 years (3 years if you’re married). This can include previously filed or amended returns, depending on the circumstances. Certified tax transcripts may be ordered by using IRS Form 4506-T.

Additionally, if you have not filed tax returns during this period at all, then you may need to show USCIS that you did not earn sufficient income to file a return. Whatever the specifics of your case may be, ensuring that your USCIS tax return requirement is satisfied is an important step in helping to prove your eligibility for citizenship. With careful preparation and attention to detail, you can feel confident that your application will stand up to USCIS scrutiny.

Law Firm 1 Tax and Immigration Services

As an immigrant in the United States, you are required to pay taxes. This includes both state and federal taxes. Tax requirements and regulations can be complex, so it’s essential to understand these requirements before filing your taxes.

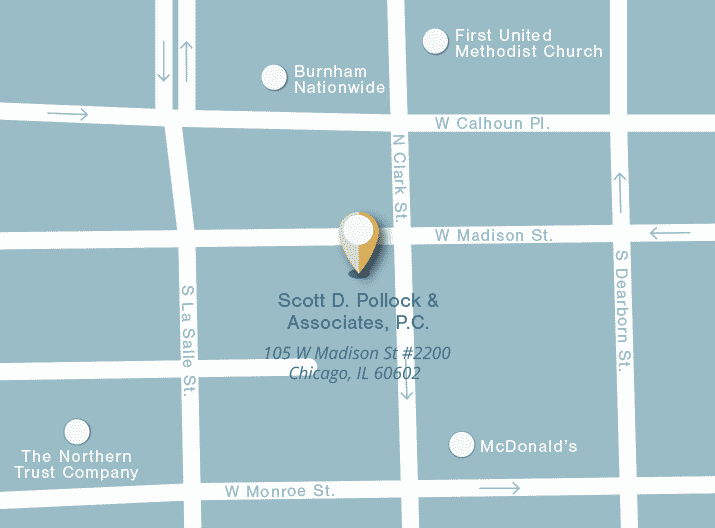

If you have any questions about your tax liability, contact the attorneys at Scott D. Pollock & Associates P.C. With over 70 years of combined experience, we have been helping individuals with nonimmigrant and immigrant visas alike navigate the tax season.

Contact us through our online contact form today. We look forward to hearing from you.

View Similar Articles